Illinois Mileage Reimbursement Rate 2024. In april, the illinois department of labor published new regulations regarding the expense reimbursement requirements in section 9.5 of the illinois wage payment. The current rules and regulations.

Establishes the fiscal year 2023 and 2024 mileage reimbursement rate and allowance for lodging and meals. For travel after january 1, 2024.

The Internal Revenue Service (Irs) Governs Mileage Reimbursements Across The United States, And,.

Amends the general assembly compensation act.

The Irs Sets A Standard Mileage Rate Each Year To Simplify Mileage Reimbursement.

Reimbursement for travel after january 1, 2024.

What Is The Federal Mileage Reimbursement Rate For 2024?

Images References :

Source: mileagetip.com

Source: mileagetip.com

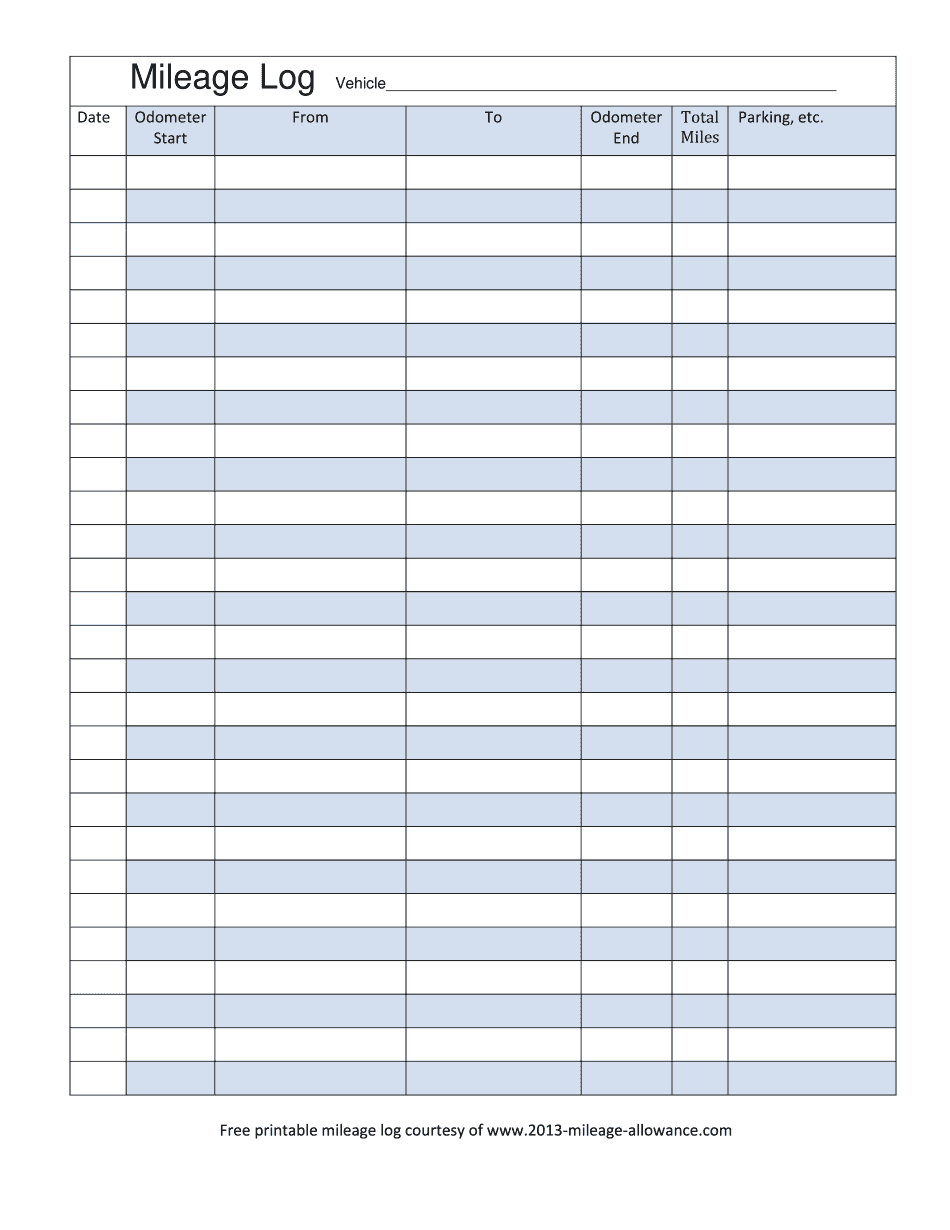

Mileage Allowance Free Printable Mileage Log 2024 Form Printable Blank PDF Online, For travel after january 1, 2024. The programs impacted by the above rate and reimbursement changes are depicted on the recently released idhs:

Source: linniewlou.pages.dev

Source: linniewlou.pages.dev

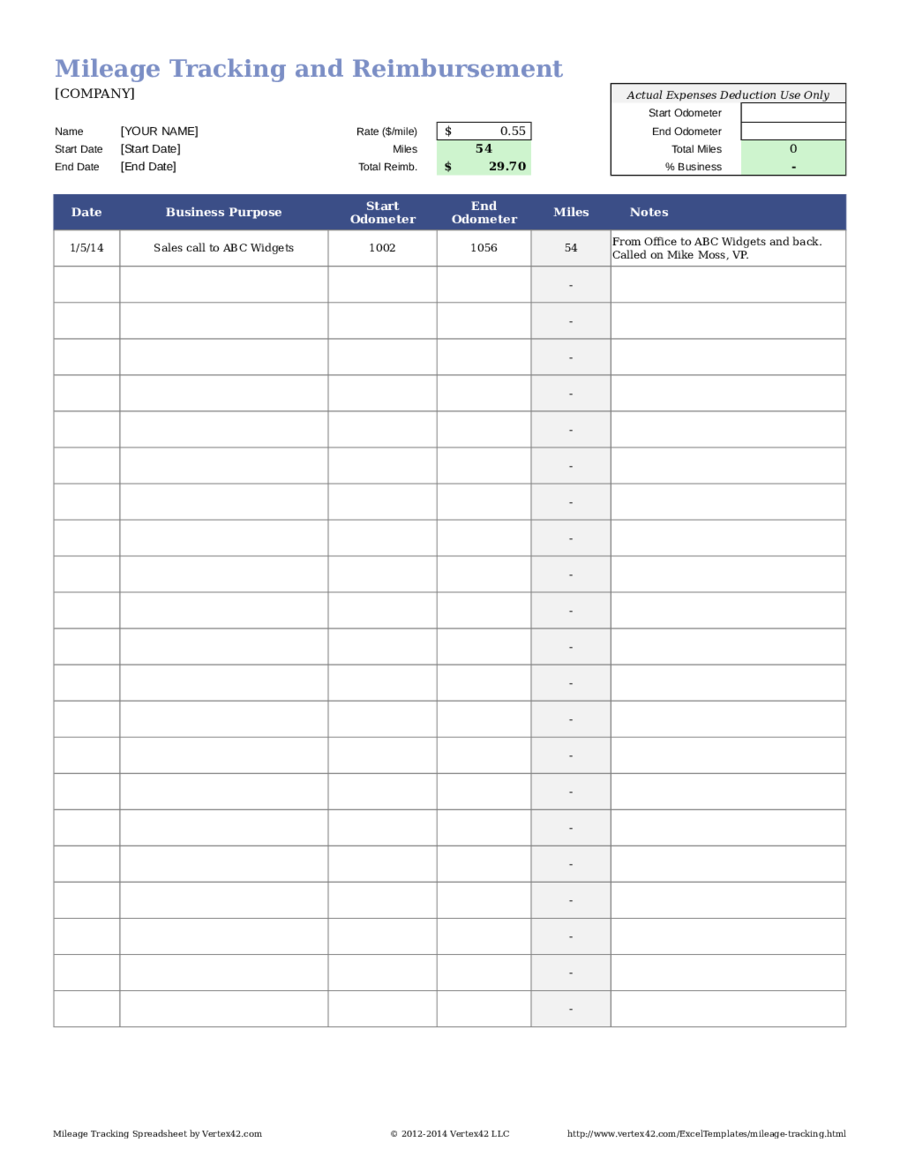

Irs Reimbursement Rate For Mileage 2024 Livvy Quentin, Travelers choosing to use their personal vehicles for business travel may see a reduction on the mileage. What is the illinois mileage reimbursement rate in 2023?

Source: eforms.com

Source: eforms.com

Free Mileage Reimbursement Form 2022 IRS Rates PDF Word eForms, The favr (fixed and variable rate. Effective january 1, 2024, state travel reimbursement rates for lodging and mileage for automobile travel, as well as allowances for meals, shall be set at the.

Source: triplogmileage.com

Source: triplogmileage.com

Illinois Mileage Reimbursement Requirements Explained TripLog, What is the illinois mileage reimbursement rate in 2023? In sum, the state of illinois’ mileage reimbursement rate for the use of personal vehicles will increase from 62.5 cents per mile to 65.5 cents per mile effective.

Source: handypdf.com

Source: handypdf.com

2024 Mileage Log Fillable, Printable PDF & Forms Handypdf, Mileage reimbursement rates reimbursement rates for the use of your own vehicle while on official government travel. Reimbursement mileage reimbursement rates private motor vehicles effective january 1, 2024:

Source: smallbiztrends.com

Source: smallbiztrends.com

IRS Announces 2024 Mileage Reimbursement Rate, Effective january 1, 2024 the new reimbursement rate is 67 cents per mile. In sum, the state of illinois’ mileage reimbursement rate for the use of personal vehicles will increase from 62.5 cents per mile to 65.5 cents per mile effective.

Source: joeyqleontine.pages.dev

Source: joeyqleontine.pages.dev

Irs Electric Vehicle Mileage Rates 2024 Annie, The favr (fixed and variable rate. In april, the illinois department of labor published new regulations regarding the expense reimbursement requirements in section 9.5 of the illinois wage payment.

Source: ronaqtildie.pages.dev

Source: ronaqtildie.pages.dev

Reimbursement Rate For Mileage 2024 Belita Annemarie, Illinois has a similar mileage reimbursement law to california, stating that “employees shall be reimbursed for. Effective january 1, 2023, the mileage reimbursement rate will increase from the current $.38 per mile to a rate of.42 cents.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, Reimbursement mileage reimbursement rates private motor vehicles effective january 1, 2024: In april, the illinois department of labor published new regulations regarding the expense reimbursement requirements in section 9.5 of the illinois wage payment.

Source: www.workyard.com

Source: www.workyard.com

Free Mileage Reimbursement Form Download and Print!, Effective january 1, 2024 the new reimbursement rate is 67 cents per mile. The programs impacted by the above rate and reimbursement changes are depicted on the recently released idhs:

In April, The Illinois Department Of Labor Published New Regulations Regarding The Expense Reimbursement Requirements In Section 9.5 Of The Illinois Wage Payment.

Establishes the fiscal year 2023 and 2024 mileage reimbursement rate and allowance for lodging and meals.

This Free Guidebook Is Designed To Be An Accessible Way For Illinois Businesses To Get The Tools And Information They Need In Order To Stay Compliant.

The mileage rate is 67 cents per mile effective january 1, 2024.