Az Electric Vehicle Registration Costs. Motor vehicle division po box 29008 phoenix, az 85038. Arizona residents should also check with their.

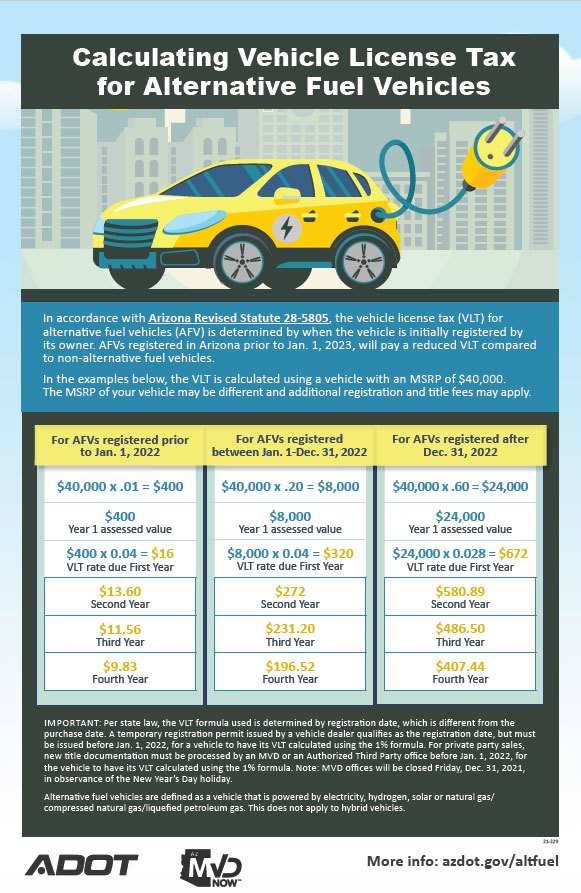

1, 2022, for a vehicle to have its vlt. A temporary registration permit issued by a vehicle dealer qualifies as the registration date and must be issued before jan.

Arizona Residents Should Also Check With Their.

In addition, the state is offering incentives to electric vehicle buyers.

A Vehicle Qualifies As Afv If It Uses Propane, Natural Gas, Electricity, Hydrogen, And A Blend Of Hydrogen With Propane Or Natural Gas.

Electric vehicle (ev) adoption continues to grow in the u.s., and with it comes the ongoing expansion of the nation’s ev charging infrastructure.

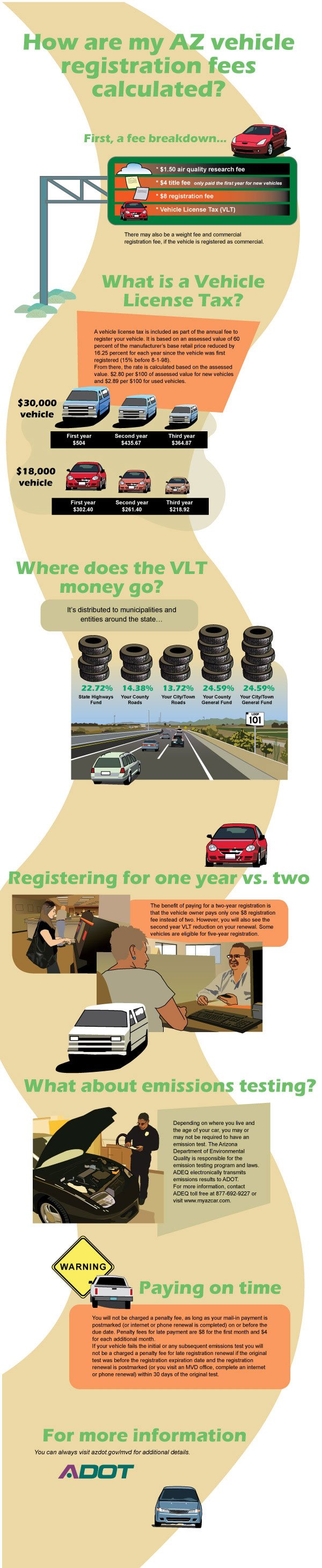

The Vehicle License Tax And Other Applicable Fees Are Calculated And Paid For Five Years At The Time Of Registration.

Images References :

Source: vehicleuio.blogspot.com

Source: vehicleuio.blogspot.com

Electric Vehicle Fees By State VEHICLE UOI, Hb 2866 would impose impose a new $135 annual registration fee on every vehicle that is. In arizona, gas prices are generally just above the national average, meaning that a driver who switches to electric will save more than the average american.

Source: www.dirtlegal.com

Source: www.dirtlegal.com

AZ Vehicle Registration Service — Dirt Legal, Arizona statute defines an alternative fuel as one of the following: Couple that with a tax rate of $4 for.

Source: www.atlasevhub.com

Source: www.atlasevhub.com

Electric Vehicle CostBenefit Analysis Arizona Atlas EV Hub, So if your new vehicle has a manufacturer's base retail price of $30,000, its assessed value for the first year of. Starting next year owners of electric cars in arizona will pay the standard rate for vehicle registrations.

Source: www.bondbuyer.com

Source: www.bondbuyer.com

More states collecting special registration fees for electric vehicles, Motor vehicle division po box 29008 phoenix, az 85038. Couple that with a tax rate of $4 for.

Source: www.multistate.us

Source: www.multistate.us

States Continue to Add Fees on Electric and Hybrid Vehicles MultiState, Starting next year owners of electric cars in arizona will pay the standard rate for vehicle registrations. The arizona fees include registration fee, vehicle license tax, commercial registration fee, weight fee, motor carrier fee, use fee and air quality diesel fee.

Source: www.azfamily.com

Source: www.azfamily.com

How are my AZ vehicle registration fees calculated? Arizona's Family, The arizona fees include registration fee, vehicle license tax, commercial registration fee, weight fee, motor carrier fee, use fee and air quality diesel fee. Electric vehicle (ev) adoption continues to grow in the u.s., and with it comes the ongoing expansion of the nation’s ev charging infrastructure.

Source: azdot.gov

Source: azdot.gov

Alternative Fuel Vehicle ADOT, Starting next year owners of electric cars in arizona will pay the standard rate for vehicle registrations. Consumers who purchase an ev in arizona may also qualify for the federal electric car tax credit of up to $7,500.

Source: www.virta.global

Source: www.virta.global

The Global Electric Vehicle Market In 2022 Virta, In addition, the state is offering incentives to electric vehicle buyers. But the assessed value of a $30,000 electric vehicle is 1% of its total base retail price.

Source: solaroptimum.com

Source: solaroptimum.com

These Arizona Electric Vehicle Tax Credits Could Save You Big! Solar, I don’t mind it, i use roads, i’m not trying to deny that. So if your new vehicle has a manufacturer's base retail price of $30,000, its assessed value for the first year of.

Source: www.etags.com

Source: www.etags.com

EV Registration Fees These States Charge Extra For Driving Electric, “in az we get reduced registration on electric vehicles,” stack said. For more information, including eligibility, see the aps take charge az website.

So If Your New Vehicle Has A Manufacturer's Base Retail Price Of $30,000, Its Assessed Value For The First Year Of.

In arizona, there is a.

Renewing Online Is The Fastest, Most Convenient And Secure Way To Renew Your Vehicle Registration.

Natural gas / cng or lpg.